By Emily Silverman |

The solar energy industry has come a long way since the early stages of its evolution. What was once a fledgling technology is now a key component of the global energy transition, accounting for 4.5% of total global electricity generation in 2022—a number that is only expected to grow.

As the industry matures, change is inevitable, and we're expecting to see some big shifts in 2024. As we settle into the new year, we have our eye on seven of the biggest trends influencing the residential solar market in 2024.

1. Interest Rates Fall, but Slowly

Interest rates have been on everyone's mind this year, with the soaring cost of solar loans resulting in a serious sales slowdown. Installers across the country are feeling the impact, with three of the largest residential solar markets in the US—Arizona, Texas, and Florida—experiencing notable declines in installed capacity.

The good news is that we expect to see interest rates fall in 2024. But will they fall fast enough to have a real impact on the 2024 solar loan market? We don't think so. Installers will have to adapt if they want to survive the slow down, and implementing a strategic marketing plan can help.

2. Third-Party Ownership Gains Traction

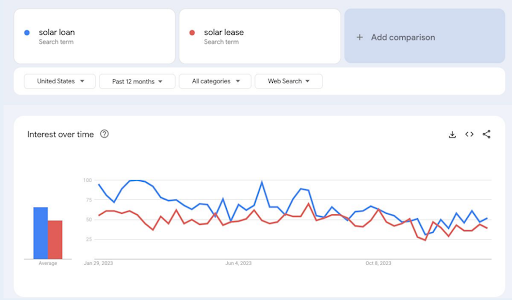

Interest rates don't affect third-party ownership (TPO) products as drastically as they affect loans, and we expect TPO installations to rise in 2024. As interest rates and inflation picked up in 2023, we saw search volume for solar leases pick up as well, closing in on search volume for solar loans (see the Google Trends chart below). Increased search volume demonstrates consumer interest, which means leases are now competing closely with loans from a homeowner interest point of view. We expect interest in TPOs to continue to increase this year, with TPO installations growing for residential installers.

3. Net Metering Is on the Chopping Block

All eyes were on California in 2023 as the number one state for solar decimated its net metering incentives. The shift from NEM 2.0 to NEM 3.0 led to a substantial drop in installations and thousands of job losses. Now, the question is, will other states follow suit?

Unfortunately, we anticipate more widespread net metering changes in 2024 (though we'd love to be wrong about this one). Historically, California has been a leader in solar policy, setting the standard for other states. We can already see this trend continuing, with Idaho switching to net billing at the tail end of 2023 and rumblings about net metering reductions getting louder in several states.

If net metering is on the chopping block in your state, you need to prepare now. We're helping residential installers in California sell solar without net metering by implementing strategic marketing tactics, and we can do the same for you.

4. The Push for Storage Continues

The silver lining to the net metering changes we're seeing is that they increase the value of batteries, and we saw major increases in battery installations in California in the wake of NEM 3.0. The need for storage is obvious, and other states, most recently Vermont and Connecticut, have introduced impressive battery storage incentives.

From a homeowner perspective, batteries provide a clearer path toward energy independence and energy security than solar panels alone. Frustration with utility control and price hikes is growing, and severe weather has started to demonstrate what conditions will look like in the face of climate change. Both of these factors drive consumer demand for battery storage—people want to feel protected and in control.

It doesn't hurt that there are some exciting new products on the market to entice consumers. FranklinWh is making a splash and Tesla Powerwall 3 is coming soon—supposedly summer 2024. Installers can tap into the excitement generated by new product releases to grow their leads with a focused content marketing strategy.

5. The Rise of Solar Maintenance

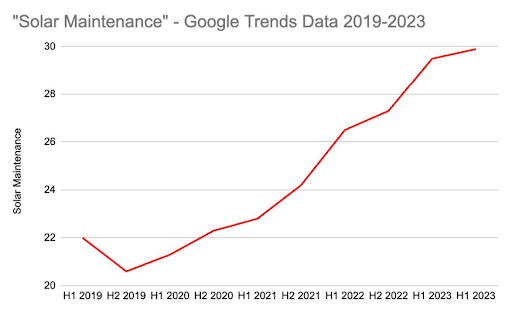

According to Google Trends data, repair and maintenance search terms are on the rise. It makes sense—there are a lot of stranded systems out there at the 5, 10, and even 15-year mark that need maintenance, and the original installer has gone out of business. Contractors can slide in and take advantage of these bottom-of-the-funnel maintenance leads, replacing inverters and repairing panels. If you play the long game, you can turn those maintenance customers into bigger jobs when their systems need to be replaced, or upsell them on battery add-ons.

6. Long-Awaited IRA Impact

After a long wait, we expect to see Inflation Reduction Act rebates for electrification upgrades like heat pumps become available in 2024, and we wouldn't be surprised to see them drive solar sales. There's a clear connection between electrification and solar, and installers have a golden opportunity to capitalize on that connection. A partnership with a strong heat pump seller could become an incredibly valuable, symbiotic relationship that drives sales for both of you while pushing the clean energy agenda forward.

7. Despite it All, Long-Term Growth

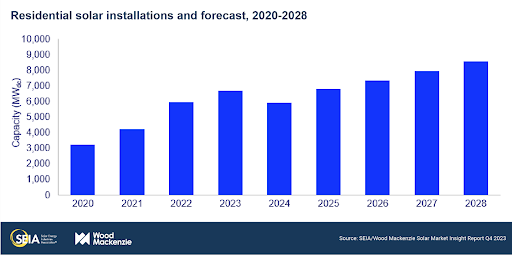

At first glance, the outlook for residential solar looks a little bleak in 2024. But at the end of the day, the industry will continue to grow. The Solar Energy Industries Association anticipates a decrease in the residential market in 2024, followed by steady upward growth in 2025 and beyond with a 10% increase each year from 2025 to 2028. Installers who adapt to changing conditions and market wisely will not only survive the slowdown but thrive as the industry recovers.